MARKET OVERVIEW:

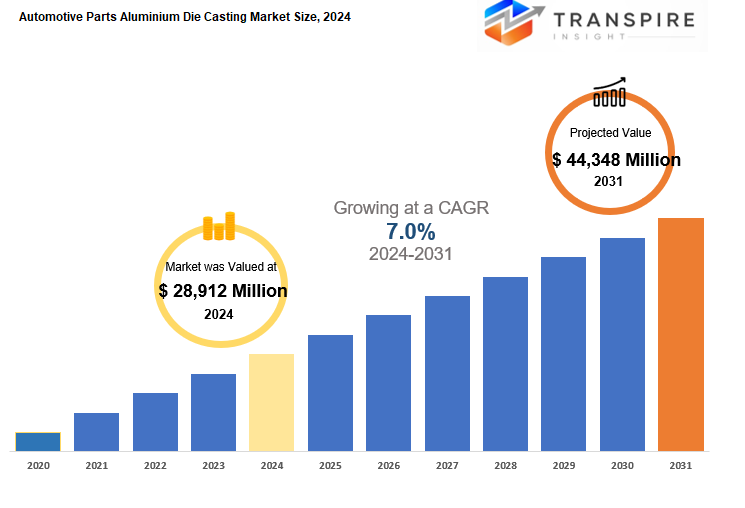

Global Automotive Parts Aluminium Die Casting market is estimated to reach $44,348 Million by 2031; growing at a CAGR of 7.0% from 2024 to 2031.

The global automotive parts aluminium die casting market is crucial for producing lightweight and durable components essential for vehicles. Manufacturers are increasingly turning to aluminium die casting to meet fuel efficiency and emission standards, as it can produce complex shapes with thin walls while maintaining structural integrity. The demand for aluminium die-cast automotive parts has surged due to the emphasis on lightweighting in the automotive sector, driven by the rising adoption of electric and hybrid vehicles that require lightweight components. Additionally, the integration of aluminium die-cast parts in advanced safety features, autonomous vehicles, and connected technologies is further fueling market growth.

Key players are continually innovating to enhance production processes and meet evolving industry requirements, focusing on strategic initiatives like mergers and acquisitions, partnerships, and investments in research and development. Advancements in die casting technology, including automation and digital manufacturing solutions, are driving efficiency improvements and enabling manufacturers to meet the increasing demand for aluminium die-cast parts with shorter lead times and higher quality standards.

With the ongoing evolution of automotive technologies and the growing demand for electric, autonomous, and connected vehicles, the market is expected to continue growing and presenting opportunities for manufacturers to thrive.

GROWTH FACTORS

The Global Automotive Parts Aluminium Die Casting market is growing due to the rising demand for lightweight automotive components to enhance fuel efficiency. The use of aluminium die casting has increased in automotive parts production to meet this demand. Another factor driving market growth is the expanding automotive production in emerging economies, where manufacturers are seeking cost-effective solutions like aluminium die casting for complex automotive parts. However, challenges include volatility in aluminium prices impacting production costs and compliance with environmental regulations adding to operational expenses.

Despite these challenges, opportunities for growth exist, especially in the adoption of aluminium die casting in electric vehicle (EV) manufacturing. The lightweight and recyclable properties of aluminium make it an attractive choice for EV components, driving further growth in the market.

Overall, stakeholders can capitalize on market potential by effectively navigating challenges and leveraging opportunities in lightweight automotive components and EV manufacturing to drive innovation in automotive parts production.

MARKET SEGMENTATION

By Production Process

The market for automotive parts made from aluminum die casting is varied and ever-changing. Different production processes like Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, and Gravity Die Casting play a crucial role in producing components for vehicles.

Pressure Die Casting, valued at 12478. 9 USD Million in 2021, is a popular method injecting molten aluminum at high pressure for precise shapes. Vacuum Die Casting, valued at 3390. 4 USD Million, uses a vacuum to reduce porosity for higher quality parts. Squeeze Die Casting, worth 2690 USD Million, involves applying extra pressure for better mechanical properties.

Gravity Die Casting, though less common, uses gravity to fill molds with aluminum for cost-effective production. Understanding these production processes is essential for stakeholders to navigate the diverse market and take advantage of emerging opportunities in the automotive industry.

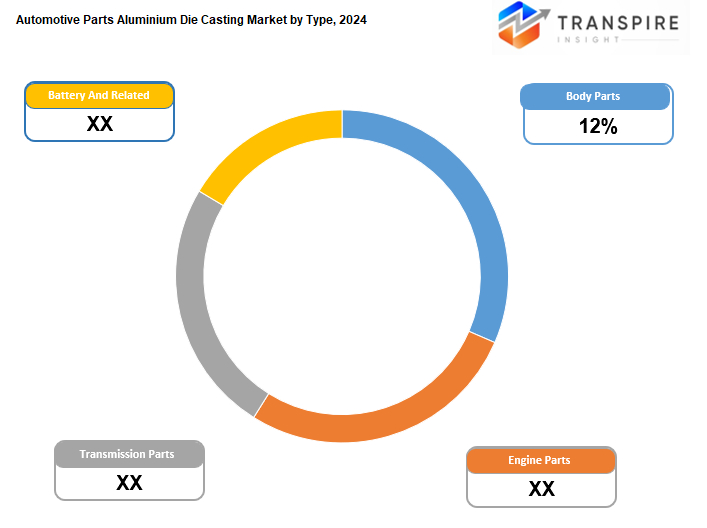

By Application

Aluminum die casting is important in the global automotive industry for making various components like body parts, engine parts, transmission parts, battery, and others. Body parts like panels and trim were worth 1914. 8 USD million in 2021. Engine parts, including blocks and pistons, need aluminum for strength and heat resistance. Transmission parts like gears and clutches were valued at 6607. 4 USD million in 2021 for smooth gearbox operations.

For battery parts, like housings and connectors, aluminum die casting is vital for electric vehicle demand. Other applications for aluminum die castings in cars include suspension, steering, heating, cooling, and safety features like airbags. The versatility of aluminum makes it suitable for various automotive applications, aiding widespread adoption.

The global automotive parts aluminum die casting market is segmented based on different applications that are crucial for manufacturing vehicles. The demand for lightweight, durable, and cost-effective components is increasing, boosting the importance of aluminum die castings in the automotive industry for future growth and innovation.

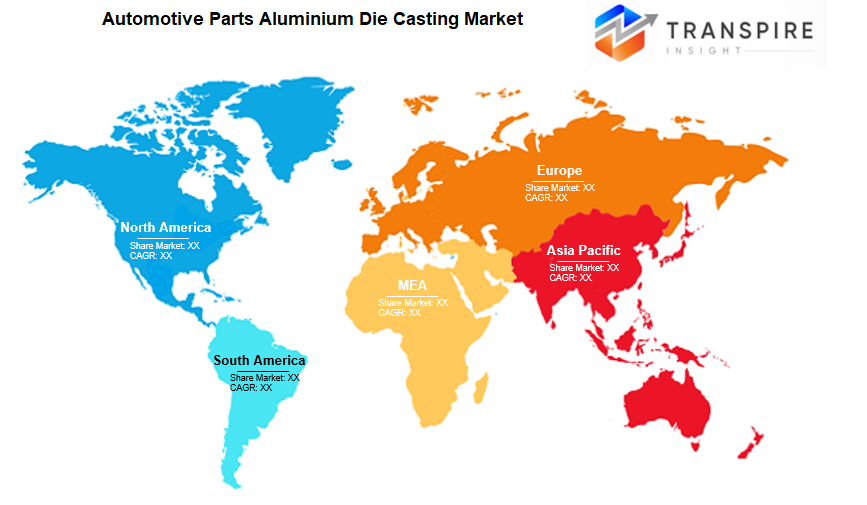

REGIONAL ANALYSIS

The Global Automotive Parts Aluminum Die Casting market is analyzed regionally to understand its dynamics in different areas. It is divided into North America, Europe, Asia-Pacific, and the rest of the world. In North America, the automotive industry is mature, with a focus on sustainability and fuel efficiency driving the demand for aluminum die casting.

Europe, like North America, emphasizes innovation and quality in automotive manufacturing, with regulations and consumer preferences for lightweight materials contributing to the market. Asia-Pacific is a dominant force due to rapid industrialization, urbanization, and government initiatives promoting electric mobility.

The rest of the world, including Latin America, the Middle East, and Africa, also have their own automotive industries with varying levels of demand for aluminum die casting. Each region has unique factors influencing market growth, such as technological advancements, regulations, consumer preferences, and government initiatives. Stakeholders need to understand these regional nuances to capitalize on emerging opportunities in the Automotive Parts Aluminum Die Casting market.

KEY INDUSTRY PLAYERS

The global automotive parts aluminum die casting market is highly competitive, with key players like Dynacast International Inc. , Nemak SAB De CV, Endurance Technologies Limited, and more. Each company has its strengths, with Dynacast focusing on precision die casting, Nemak on innovation, and Endurance on research and development.

Other notable players include Shiloh Industries, known for lightweighting solutions, and Gibbs Die Casting Corp. , recognized for technical expertise. Bocar, S. A. de C. V. has a strong presence in North America, while Koch Enterprises prioritizes sustainability practices. Rockman Industries is a top supplier for motorcycles, expanding into the automotive sector.

Each company contributes to the market's competitiveness through innovation, quality, and customer satisfaction. Overall, these players bring diverse capabilities to the market, catering to the evolving needs of automotive manufacturers worldwide.

REPORT SCOPE AND SEGMENTATION

|

Attributes |

Details |

|

Market Size By 2031 |

USD 44,348 Million |

|

Growth Rate |

CAGR of 7.0% |

|

Forecast period |

2024 - 2031 |

|

Report Pages |

250+ |

|

By Production Process |

|

|

By Application |

|

|

By Region |

|

|

Key Market Players |

|

_page-000134.jpg)

_page-000140.jpg)

_page-000139.jpg)

_page-000138.jpg)

_page-000137.jpg)

APAC:+91 7666513636

APAC:+91 7666513636