MARKET OVERVIEW:

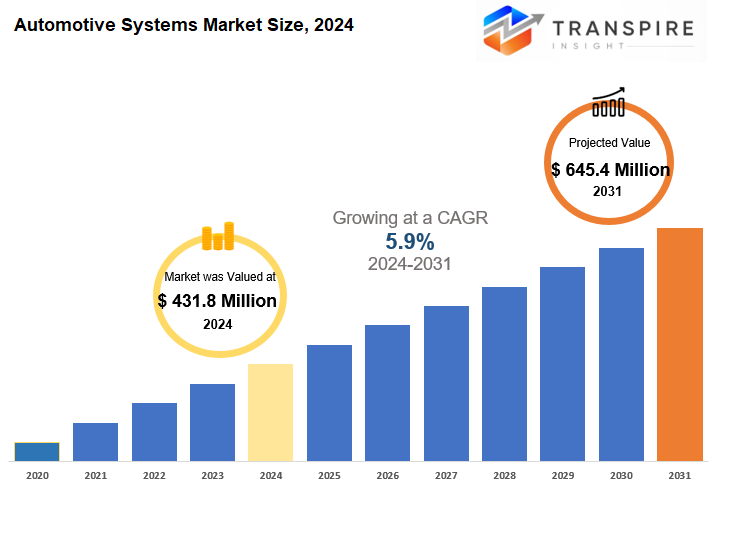

Global Automotive Systems market is estimated to reach $645.4 Million by 2031; growing at a CAGR of 5.9% from 2024 to 2031.

The automotive sector is crucial in the development and integration of various in-vehicle systems and technologies. It impacts vehicle functionality, safety, and performance through powertrains, electronics, safety mechanisms, and infotainment solutions. Vehicle technology plays a central role in the Global Automotive Systems market, encompassing safety, connectivity, and efficiency, including the rise of electric and hybrid vehicles. Advanced systems like autonomous driving, ADAS, and vehicle communication are also emerging. Vehicle safety is a top priority, with advanced safety systems like collision avoidance and lane-keeping assistance becoming more prevalent. These systems rely on sensors, cameras, and software algorithms to enhance road safety. Infotainment systems have evolved from basic radio/navigation systems to comprehensive platforms offering connectivity, entertainment, and communication. The market is expected to integrate AI and personalized features to enhance the driving experience.

The Global Automotive Systems market will face challenges and opportunities, including the need for new powertrain technologies and energy management systems for electrification. Increasing autonomous vehicles will also drive the demand for advanced systems supporting high levels of automation. The market's response to these trends will shape the future of the automotive industry, guiding progress and influencing vehicle design and functionality. Ultimately, the market plays a crucial role in driving innovation and shaping the future of transportation, impacting various aspects of the automotive business from propulsion to safety, infotainment, and connectivity. As it continues to evolve, it will define how future vehicles are built and experienced.

GROWTH FACTORS

The global Automotive Systems market is poised for significant growth due to various economic factors. Rapid technological advancements, particularly in automation and connectivity, are driving demand for advanced automotive systems that enhance driving experiences and safety features. Concerns about environmental sustainability have also fueled investments in electric and hybrid technologies, leading to the need for technically advanced automotive systems. Consumer preferences for comfort, convenience, and personalization are shaping the market, with a growing demand for systems like information and entertainment, adaptive cruise control, and personalized driving modes.

Globalization and rising disposable incomes in emerging markets are further boosting demand for high-quality automotive systems, especially in regions like the Asia-Pacific. Looking ahead, continuous innovation, adaptation to new challenges, and the rise of autonomous vehicles, artificial intelligence, and energy efficiency are expected to drive further growth in the Automotive Systems market.

Overall, a combination of technological advancements, environmental concerns, consumer preferences, and economic factors are driving robust growth in the market with promising opportunities for businesses and consumers in the future.

MARKET SEGMENTATION

By Type

The Global Automotive Systems market is undergoing significant changes due to advancements in technology and changes in customer preferences. Different components of the automotive systems, such as engine, transmission, suspension, steering, braking, exhaust, electrical, and infotainment systems, are all evolving to meet the demands of the future.

The engine system is focusing on improved performance and fuel efficiency to comply with stricter emissions regulations, leading to advanced engine management systems and turbocharging technologies. The transmission system is adapting to the trend of electrification and hybridization with CVTs, dual-clutch systems, and more efficient technologies for better performance and sustainability.

Suspension systems are incorporating new materials and adaptive features for stability and comfort, while steering systems are integrating advanced driver-assistance technologies for higher efficiency and performance. Braking systems are implementing advanced ABS and ESC technologies to enhance safety and stability.

Exhaust systems are evolving to comply with environmental policies by improving catalytic converters and developing new materials to reduce emissions and increase fuel efficiency. Electrical systems are expanding with the increase in electronic components, especially in electric and hybrid vehicles, leading to better battery management and power distribution.

Technologies like adaptive cruise control, lane-keeping assist, and automatic emergency braking are becoming more common to enhance safety and autonomy in vehicles. Infotainment systems are incorporating more advanced interfaces and connectivity features for an improved user experience.

The evolution of fuel systems is moving towards biofuels and hybrid technologies, with innovations in fuel injection systems and alternative fuel technologies driving efficiency improvements and reducing environmental impacts. Overall, these advancements in automotive systems aim to improve vehicle performance and contribute to a more sustainable and connected automotive future.

By Application

The Global Automotive Systems market is evolving with advancements in transportation. Different vehicle types, including passenger cars, light commercial vehicles, and heavy commercial vehicles, are adapting to modernization. Passenger vehicles are expected to change significantly due to technology advancements, with electric and autonomous vehicles leading the way. This shift is driven by environmentally conscious consumers and regulatory requirements.

In the light commercial vehicles segment, greener technologies like CNG and hydrogen fuel cells are likely to be integrated, alongside telematics and connectivity for efficient fleet management. Heavy commercial vehicles, vital in the global supply chain, will focus on fuel efficiency and reduced emissions through innovations like hybrid powertrains and autonomous systems.

With an increasing focus on sustainability, connectivity, and automation, the future of the automotive market will continue to evolve, shaping the transportation of people and goods worldwide.

By End User

The Global Automotive Systems market is shaped by technology and consumer needs. The market will continue to grow influenced by factors like technological innovation and user preferences. The market is divided into OEMs, who make parts for new vehicles, and the Aftermarket, which provides parts for existing vehicles.

The Aftermarket focuses on maintaining and improving older vehicles. With new technologies emerging, like driver assistance systems and electric vehicle technology, both OEMs and the Aftermarket will need to adapt to remain competitive.

The market will be driven by a focus on both new vehicle technology and maintaining older vehicles. In summary, the market will keep growing, with OEMs leading in new vehicle technology and the Aftermarket meeting the needs of existing vehicle owners.

REGIONAL ANALYSIS

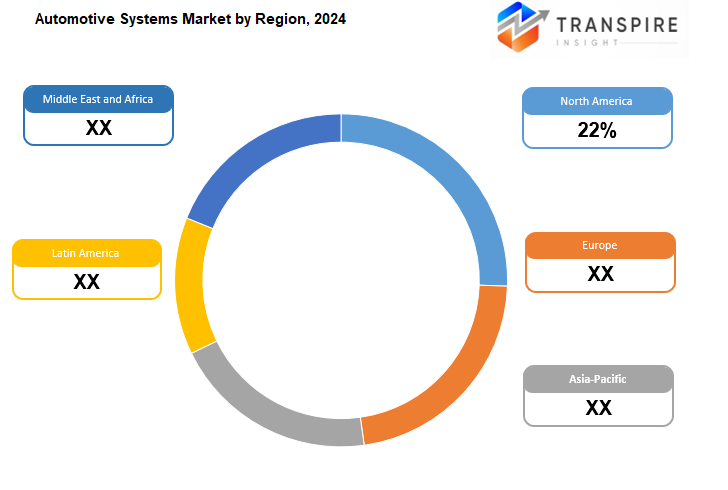

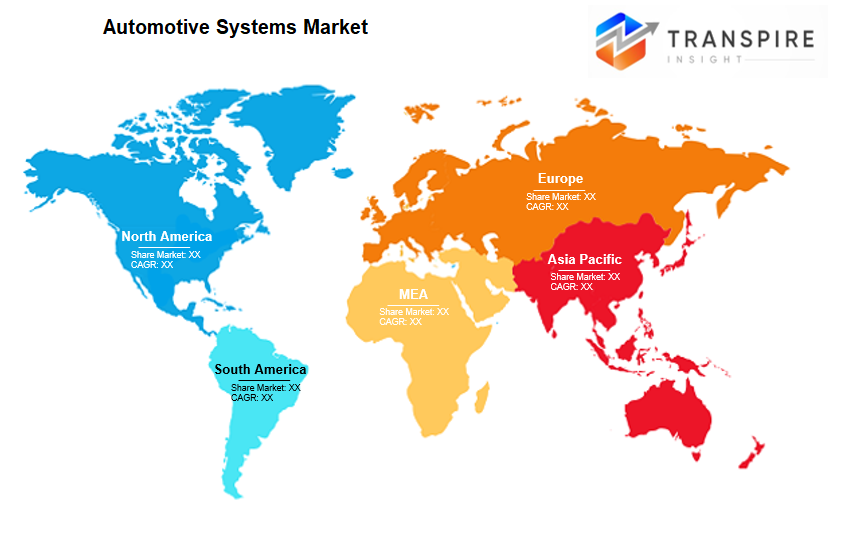

The Global Automotive Systems market is segmented by geography, with key regions being North America, Europe, Asia-Pacific, South America, and Middle East & Africa. In North America, the U. S. , Canada, and Mexico each present unique opportunities and challenges for automotive systems due to technological adoption and regulatory environments. In Europe, countries like the UK, Germany, France, and Italy prioritize sustainability and regulatory compliance, driving demand for advanced automotive systems.

In Asia-Pacific, India, China, Japan, and South Korea are key players with a focus on new technologies and electric vehicle adoption. South America's market is led by Brazil and Argentina, evolving with demand for better vehicles and infrastructural investments. In the Middle East & Africa, the GCC countries, Egypt, and South Africa are investing in modern automotive technologies to meet regional demands.

Different regions face challenges and opportunities in the global automotive systems market, influenced by new technologies, regulatory changes, economic conditions, and consumer preferences. The industry will continue to evolve, with each geography adapting to changes in the market over time.

KEY INDUSTRY PLAYERS

The global automotive systems market is experiencing significant changes driven by key players such as Robert Bosch GmbH, Denso Corporation, ZF Friedrichshafen AG, and Continental AG. These companies are leading in developing cutting-edge technologies that enhance vehicle performance, safety, efficiency, and connectivity. Robert Bosch GmbH is a major player due to its wide range of automotive components and innovative solutions. Denso Corporation's heavy investment in research and development has resulted in valuable contributions to automotive electronics and climate control systems.

ZF Friedrichshafen AG specializes in driveline and chassis technology, while Continental AG advances tire and braking systems for improved safety and performance. Magna International Inc. and Aisin Seiki Co. , Ltd. provide innovative solutions covering various automotive needs, including advanced driver-assistance systems and drivetrain technologies for electric vehicles.

Panasonic Corporation focuses on car infotainment and electric components, while Aptiv PLC specializes in connectivity and autonomous driving technologies. Autoliv Inc. , BorgWarner Inc. , Hyundai Mobis, and Valeo SA are also key players in developing safety systems, hybrid technologies, auto parts, and lighting and wiper systems, respectively.

These players are shaping the future of the automotive systems market by continuously advancing technology and enhancing vehicle performance to meet the evolving demands of the industry. Their efforts are crucial in driving the innovation and development of tomorrow's automotive landscape.

REPORT SCOPE AND SEGMENTATION

|

Attributes |

Details |

|

Market Size By 2031 |

USD 645.4 Million |

|

Growth Rate |

CAGR of 5.9% |

|

Forecast period |

2024 - 2031 |

|

Report Pages |

250+ |

|

By Type |

|

|

By Application |

|

|

By End User |

|

|

By Region |

|

|

Key Market Players |

|

_page-000136.jpg)

_page-000140.jpg)

_page-000139.jpg)

_page-000138.jpg)

_page-000137.jpg)

APAC:+91 7666513636

APAC:+91 7666513636