MARKET OVERVIEW

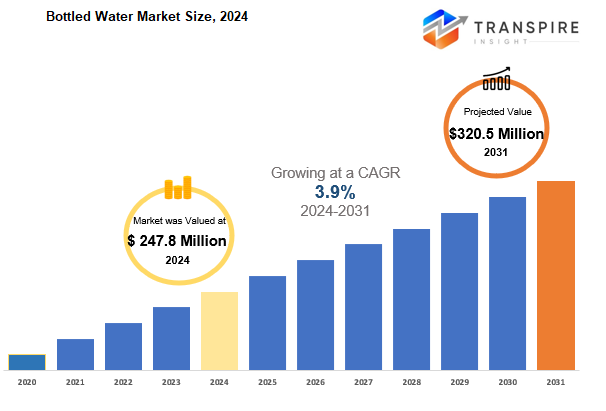

Global Bottled Water market is estimated to reach $320.5 Billion by 2031; growing at a CAGR of 3.9% from 2024 to 2031.

The Global Bottled Water market plays a crucial role in the beverage industry, reflecting consumer choices and trends in water consumption worldwide. With a wide range of products, including still and sparkling water in various packaging formats, bottled water remains a preferred choice for many consumers due to its convenience, portability, and perceived purity. As consumers become more health and environmentally conscious, the demand for bottled water is expected to continue to grow.

The market for bottled water is expansive, catering to a diverse range of consumers' needs and preferences in both urban and rural areas. From single-serve bottles to larger containers, the market offers a variety of options to accommodate different lifestyles. Urban areas, with their fast-paced lifestyles, present a significant market for bottled water, as consumers seek convenient hydration solutions. Emerging markets are also contributing to the growth of the bottled water market as more consumers choose it over traditional soft drinks.

Distribution channels such as major retailers, supermarkets, and convenience stores play a vital role in selling bottled water to consumers. However, the rise of e-commerce and subscription services is reshaping the distribution landscape, offering more convenience to consumers. Natural disasters and water scarcity issues further drive the demand for bottled water as an essential commodity during emergencies. With changing consumer preferences and increasing concerns about plastic use, the market is expected to see innovations in sustainable packaging solutions and eco-friendly products to meet the evolving needs of consumers.

GROWTH FACTORS

The Global Bottled Water market has experienced consistent growth due to various factors influencing consumer preferences. One of the primary drivers behind this growth is the increasing focus on health and wellness among consumers. With a rising awareness of the importance of staying hydrated and choosing healthier beverage options, bottled water has emerged as a popular choice. The convenience of bottled water for individuals on the go, whether for work, travel, or exercise, has contributed to its high demand. As the trend towards health-conscious living continues to rise globally, the bottled water market is expected to further expand.

Another significant factor fueling the growth of the bottled water market is the global increase in population and urbanization. As cities expand and access to clean water becomes more challenging, bottled water serves as a convenient and safe alternative. In many developing countries, bottled water is considered a safer choice compared to untreated water sources, which may pose health risks. Despite these advantages, the market faces challenges, particularly concerning environmental issues such as plastic pollution. Heightened awareness of the negative impact of plastic bottles on the environment has prompted companies to explore more eco-friendly packaging options to reduce their carbon footprint.

Looking ahead, the Global Bottled Water market is poised for a sustainable future with a focus on green packaging and technological advancements in purification and filtering systems. Companies are expected to invest in biodegradable materials and reusable bottles to attract environmentally conscious consumers. The introduction of flavored and functional bottled waters presents opportunities for market growth and diversification. Although challenges persist, including concerns about the cost of bottled water and environmental sustainability, the industry is adapting to meet modern consumer demands and is positioned for continued success in the future.

MARKET SEGMENTATION

By Product Type

The Global Bottled Water market is experiencing steady growth due to the increasing preference for convenient hydration options. Consumers are drawn to bottled water for its portability and purity benefits, especially in light of the rising health and wellness awareness. As a result, the market is expected to continue expanding as brands evolve to meet changing consumer preferences. With more people opting for healthier beverage choices and avoiding sugary drinks, bottled water has gained popularity worldwide.

The market is segmented into various categories based on product type, with still bottled water remaining the dominant choice for consumers. Sourced from springs or treated to remove impurities, still bottled water offers a simple and refreshing hydration option that appeals to a wide range of consumers. Its pure taste, diverse sizes, and packaging formats make it easily accessible to individuals of all backgrounds. The future of still bottled water looks promising as it meets the growing demand for hassle-free hydration among both young and old consumers.

Carbonated bottled water is another product category that has gained traction in recent years, providing a fizzy alternative to still water for those who enjoy carbonation but want to avoid sugary drinks. With flavored and sparkling waters becoming increasingly popular, the future of carbonated bottled water looks bright. As consumers seek lower-calorie options with added minerals, this product segment is poised for further expansion as a refreshing and healthy choice. Additionally, functional bottled water containing added nutrients, vitamins, electrolytes, and herbal ingredients is expected to grow exponentially as consumers seek beverages with targeted health benefits. As consumer demand for lifestyle-specific beverages increases, the market will continue to innovate with new flavors, natural minerals, and eco-friendly packaging options to cater to diverse needs.

By Packaging

Consumer demand for easy hydration is expected to be a significant driving force behind the growth of the Global Bottled Water market in the future. As consumers increasingly prioritize health and wellness, bottled water is considered a healthier alternative to sugary beverages. The continuous rise in the global population is further contributing to the growing demand for bottled water. To meet changing consumer preferences, bottled water manufacturers are likely to adopt new packaging and marketing strategies. By embracing new technologies and environmentally friendly practices, companies can effectively cater to evolving consumer demands and ensure the market remains adaptable to future changes.

Within the Global Bottled Water market, packaging plays a crucial role and is categorized into various forms, with PET (polyethylene terephthalate) being the most commonly used material. PET is preferred for its lightweight, durable nature, and ease of recycling, making it a popular choice among manufacturers. Despite its current dominance, there is a growing push for more sustainable alternatives due to increasing environmental concerns. Companies may explore options like biodegradable plastics or paper-based bottles to reduce their environmental impact while still meeting consumer convenience needs. The demand for such eco-friendly packaging materials is expected to rise as governments and businesses focus more on sustainability and addressing plastic pollution.

While PET bottles continue to be a prevalent packaging option, cans are anticipated to gain popularity in the future within the Global Bottled Water market. Aluminum cans are highly recyclable and can be reused multiple times without compromising quality. As environmental issues become a priority for consumers, cans offer a compact packaging solution that is easy to transport, potentially reducing carbon emissions in the supply chain. Additionally, other innovative packaging materials like glass bottles and paper cartons made from sustainable sources are also gaining attention. These materials cater to consumers seeking luxury and environmentally friendly products, driving packaging innovations in the market towards greater sustainability while meeting the increasing demand for bottled water worldwide.

By Sales Channel

The Global Bottled Water Market has experienced steady growth in recent years, driven by consumer concerns for healthier lifestyles, rising incomes, and the desire for convenience. This trend is expected to continue in the future as more individuals choose bottled water for hydration over sugary beverages or tap water. To sustain this growth, the market will rely on a variety of sales channels to shape its trajectory.

Segmented by sales channels such as supermarkets/hypermarkets, convenience stores/drug stores, grocery stores/club stores, foodservice, and others, the Global Bottled Water market will see different levels of contribution from each. Supermarkets and hypermarkets are projected to maintain dominance, offering a range of bottled water options to cater to diverse consumer needs. Convenience stores and drug stores will play a crucial role in meeting the demand for quick and easy access to bottled water, especially for busy individuals. Additionally, grocery stores and club stores will continue to provide bulk options for cost-effective purchases, while the foodservice sector will integrate bottled water into dining experiences to align with health and wellness trends. As e-commerce continues to grow, online marketplaces and direct-to-consumer platforms will also emerge as significant channels for bottled water sales, ensuring broad accessibility to consumers worldwide.

REGIONAL ANALYSIS

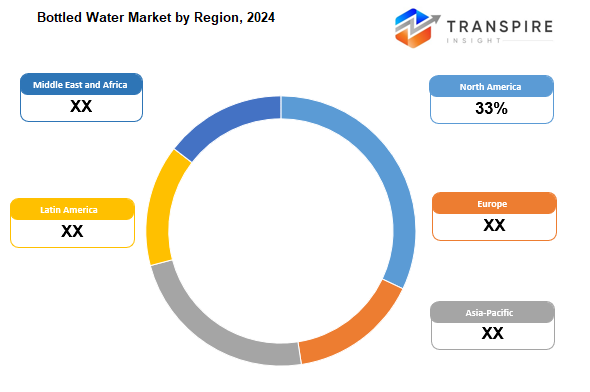

The globalization of bottled water has resulted in a significant increase in the global market, with contributions from various regions worldwide. The demand for bottled water is primarily driven by health-conscious consumers who understand the importance of staying hydrated. Market growth varies across different regions, with geo-climatic factors playing a crucial role in shaping the industry's development. North America, Europe, Asia-Pacific, South America, and the Middle East & Africa all play unique roles in influencing trends and dynamics within the bottled water market.

North America stands out as the leading consumer of bottled water, particularly driven by the United States, Canada, and Mexico. The United States, in particular, has a strong demand for bottled water due to the convenience it offers for on-the-go hydration. Increasing health awareness and a shift towards healthier alternatives have also contributed to the region's market growth. While Canada and Mexico have stable demand, their market sizes are relatively smaller. North America is expected to see new trends emerge, including a growing demand for greener packaging solutions.

Europe, including countries like the UK, Germany, France, and Italy, is also a significant player in the global bottled water market. There has been a noticeable shift towards health-conscious drinking habits in Europe, with a preference for bottled water over carbonated beverages. Countries like Germany and France are expected to lead the market, driven by the increasing demand for premium types of bottled water. The UK and Italy, on the other hand, are likely to see a shift towards flavored water and more sustainable packaging options as environmental awareness continues to grow.

COMPETITIVE PLAYERS

In response to the rising demand for pure and convenient hydration options, the global bottled water market has experienced significant growth and transformation. Consumers are increasingly prioritizing health and wellness, leading to a surge in the consumption of bottled water products. This trend has intensified competition within the industry, prompting major players to innovate and adapt to changing consumer preferences. Moving forward, the global bottled water market is poised to be influenced by key factors that drive innovation and competition.

Leading companies such as Nestlé S.A., PepsiCo Inc., Danone S.A, and The Coca-Cola Company have established a strong presence in the global bottled water market. These industry giants offer a wide range of flavored and non-flavored bottled water products to cater to diverse consumer needs. Companies like Nestlé are expanding into premium and functional waters to appeal to health-conscious consumers who seek more than just hydration. Competition from PepsiCo and Coca-Cola is also on the rise, with brands like Aquafina and Dasani gaining popularity across various markets.

In addition to major players, regional companies like Mountain Valley Spring Company, Bisleri International, and Parle Agro Pvt. Ltd have captured significant market share in their respective regions. Bisleri, a leader in the Indian market, and Parle Agro's Bisleri brand are well-established names known for their quality and reliability. Other niche brands such as Fiji Water, Nongfu Spring, and BlueTriton Brands cater to specific audiences with premium and sustainably sourced bottled water options. As the market continues to grow, there is a growing emphasis on sustainability, with start-up companies exploring eco-friendly packaging alternatives. The future of the global bottled water market will be shaped by innovation, sustainability, and a focus on health-conscious consumers, driving competition and diversity in product offerings.

REPORT SCOPE AND SEGMENTATION

|

Attributes |

Details |

|

Market Size By 2031 |

USD 320.5 Billion |

|

Growth Rate |

CAGR of 3.9% |

|

Forecast period |

2024 - 2031 |

|

Report Pages |

250+ |

|

By Product Type |

|

|

By Packaging |

|

|

By Sales Channel

|

|

|

By Region |

|

|

Key Market Players |

|

.jpg)

_page-000159.jpg)

_page-000158.jpg)

_page-000157.jpg)

APAC:+91 7666513636

APAC:+91 7666513636