MARKET OVERVIEW:

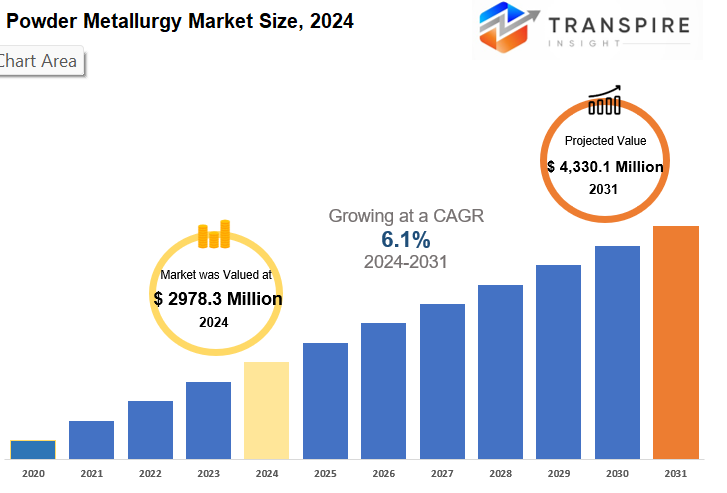

Global Powder Metallurgy market is estimated to reach $4,330.1 Million by 2031; growing at a CAGR of 6.1% from 2024 to 2031.

The Global Powder Metallurgy market focuses on the use of metal powders in various industries like automobiles, aircraft, electronics, and medical devices. The processes involved include powder formation, compaction, and sintering to create high-performance components. Innovations in powder production methods, such as gas atomization, water atomization, or mechanical milling, will increase efficiency and sustainability by producing powder tailored for specific applications.

The market will feature a wide range of materials, from conventional ones like iron and copper to advanced alloys and composite powders. Specialty powders with improved mechanical properties will be common, benefiting sectors like aerospace and defense. The integration of digital technologies and principles of Industry 4. 0 will optimize production processes in real-time, enhancing precision and efficiency.

Sustainability is becoming a key theme in the market, with a focus on eco-friendly practices like recycling metal powders and using renewable energy sources. The market will be diverse geographically, with players from North America, Europe, Asia-Pacific, and Latin America. China and India will be important countries in this market. Overall, the Global Powder Metallurgy market will continue to evolve with technology innovations, new materials, digital transformation, and sustainability initiatives to meet the changing needs of various industries and drive future growth opportunities.

GROWTH FACTORS

The global powder metallurgy market is experiencing rapid growth driven by the demand for lightweight and high-strength components in automotive and aerospace sectors. Manufacturers are turning to powder metallurgy to develop parts that are lighter and stronger compared to traditional materials, in response to increasing pressure to improve fuel efficiency and performance while reducing emissions.

The use of additive manufacturing and 3D printing technologies utilizing metal powders is also contributing to market growth by allowing for more design freedom. However, there are challenges such as high setup costs, limited material options, and the complexity of the processes, which require skilled labor and expensive equipment.

Despite these challenges, innovations in metal powder technologies and the design of new alloys are expected to open new opportunities for powder metallurgy applications in various sectors, leading to continued market growth. Overall, the market is poised for expansion as companies recognize the benefits of these technologies and adapt to meet evolving regulatory standards and consumer expectations.

MARKET SEGMENTATION

By Material

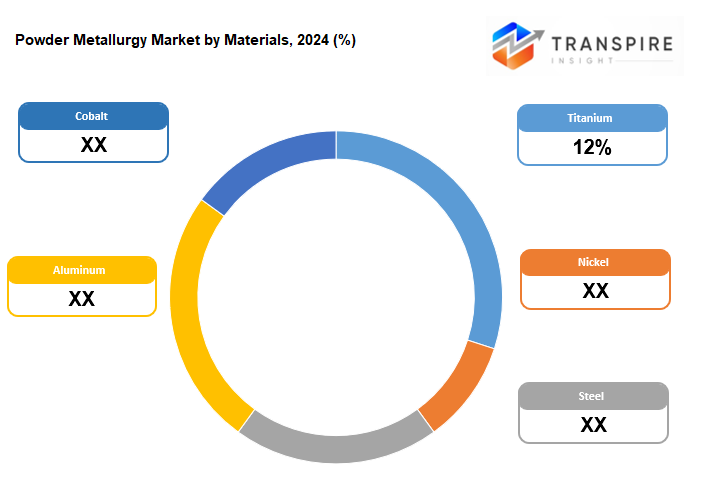

The global powder metallurgy market is thriving as industries discover the diverse applications of this manufacturing process. Metal parts are created from powdered materials, compacted, and sintered to form solid objects.

Titanium is widely used due to its high strength and lightweight properties, particularly in aerospace and medical industries. Nickel's corrosion resistance and ability to withstand high temperatures make it a popular choice for turbine blades and chemical processing equipment. Steel remains a dominant material in the market, valued for its flexibility and cost-effectiveness. Aluminum is sought after for its lightweight and machinability, especially in the automotive industry for fuel efficiency. Cobalt, although less commonly used, is valued for its hardness and wear resistance, making it ideal for cutting tools and high-performance parts.

The industry is constantly developing new powders to meet evolving industry needs, driving innovation and growth in the global powder metallurgy market to create advanced materials suited for a rapidly changing world.

By Process

The Global Powder Metallurgy market is growing due to advanced manufacturing processes being adopted across various industries like automotive, aerospace, and electronics. Additive Manufacturing is a key process that allows for intricate design possibilities and reduced waste, leading to increased demand.

Powder Metal Hot Isostatic Pressing is another important process that enhances the strength of metal powders for industries like aerospace and defense. Metal Injection Molding combines plastic injection molding and powder metallurgy to produce complex parts with tight tolerances, benefiting sectors like medical and electronics.

These processes are advancing, offering efficient and innovative solutions to meet the evolving needs of different industries. The future of Powder Metallurgy looks promising with continued technological advancements and increased demand for greener and more efficient manufacturing techniques.

By End Use

The Global Metal Processing Machines market is set to experience significant changes due to technological advancements and increasing demand across various industries. Automation and smart manufacturing are driving the market, leading to the implementation of advanced machines with higher precision and productivity.

The Powder Metallurgy market, a key segment, is largely dominated by Original Equipment Manufacturers (OEMs) and Additive Manufacturing (AM) operators, particularly in industries like automotive and aerospace. Additive manufacturing operators are shaping 3D printing technology by requiring high-quality machines for metal parts production. Sustainability is becoming crucial in the industry with a focus on greener practices and energy-efficient machines.

Overall, the market's future looks promising with innovation, technology advancement, automation, and sustainability driving growth. It is essential for manufacturers to adapt to changing needs and provide customized solutions to meet evolving demands in the market.

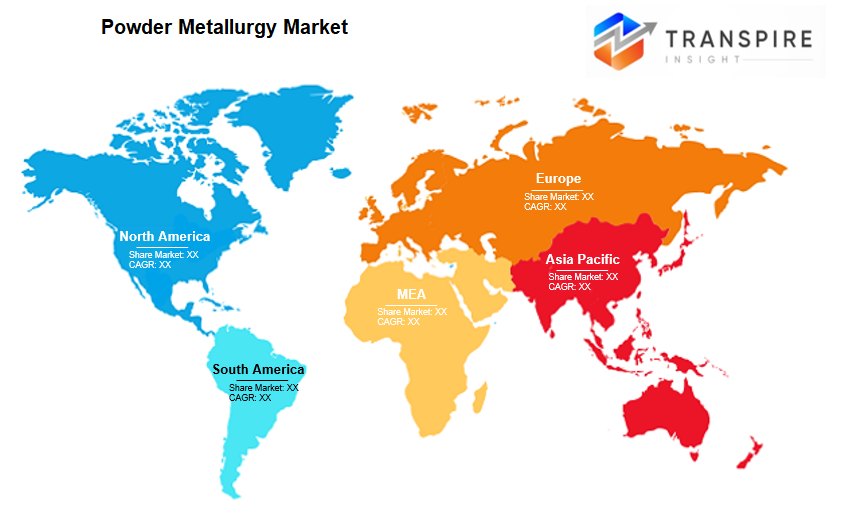

REGIONAL ANALYSIS

Based on geography, the global Powder Metallurgy market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific.

The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

KEY INDUSTRY PLAYERS

Key players operating in the Powder Metallurgy industry include Molyworks Materials Corporation, Advanced Technology & Materials Co., Ltd. (AT&M), JSC POLEMA, Sandvik AB, Höganäs AB, GKN PLC, Rio Tinto Metal Powders, Rusal, CRS Holdings Inc., Liberty House Group, AP&C (Advanced Powders & Coatings), ATI Powder Metals, Aubert & Duval, Fine Sinter Co., Ltd., Kennametal Inc., Hitachi Chemical Co., Ltd.

REPORT SCOPE AND SEGMENTATION

|

Attributes |

Details |

|

Market Size By 2031 |

USD 4,330.1 Million |

|

Growth Rate |

CAGR of 6.1% |

|

Forecast period |

2024 - 2031 |

|

Report Pages |

250+ |

|

By Material |

|

|

By Process |

|

|

By Application |

|

|

By End Use |

|

|

By Region |

|

|

Key Market Players |

|

_page-000145.jpg)

_page-000149.jpg)

_page-000148.jpg)

_page-000147.jpg)

_page-000146.jpg)

APAC:+91 7666513636

APAC:+91 7666513636