MARKET OVERVIEW:

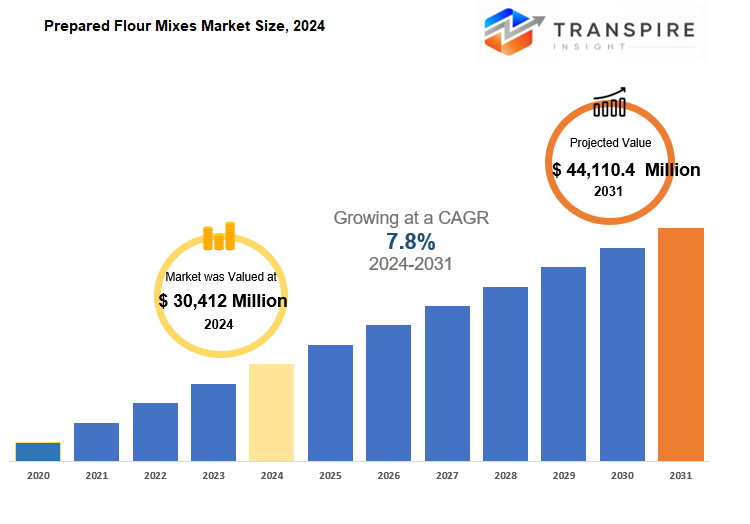

Global Prepared Flour Mixes market is estimated to reach $44,110.4 Million by 2031; growing at a CAGR of 7.8% from 2024 to 2031.

The global prepared flour mixes market focuses on creating ready-to-use flour-based products that save time and offer convenience in baking and cooking. The market caters to both consumers and foodservice operators, ensuring consistent taste and quality across various culinary applications. The industry involves a mix of large-scale manufacturers and small-scale artisan producers, each contributing to the market's evolution based on consumer preferences and technological advancements.

Innovations like biodegradable packaging, advanced flour mixing technologies, and digital transformation are shaping the future of the prepared flour mixes market. E-commerce platforms, social media, and direct-to-consumer sales will play significant roles in expanding the market's footprint. Different regions will exhibit unique cuisine preferences, consumer choices, and regulatory environments, affecting the market's growth differently.

Companies in the prepared flour mixes market will need to adapt to changing regional dynamics, competitive threats, and regulatory factors. Transparency in ingredient disclosure and sourcing will be crucial for building trust with consumers. Competition will be fierce between multinational corporations and innovative startups, with differentiation strategies, branding, and customer engagement playing key roles in gaining market share.

Strategic partnerships, mergers, and acquisitions will be essential for companies looking to consolidate their positions and expand their geographical reach. The market will continue to evolve in response to consumer preferences, technological advancements, and geographical dynamics, ensuring a broad range of products to meet specific customer needs and maintaining its relevance within the global food industry.

GROWTH FACTORS

The Global Prepared Flour Mixes market has experienced significant growth due to the demand for convenient baking solutions. With busy lifestyles, people are turning to prepared flour mixes for easy and quick baking. These mixes eliminate the need to measure and mix individual ingredients, making baking simpler for both experienced and novice bakers. The rise in home baking during the COVID-19 pandemic has further boosted the demand for prepared flour mixes, as people sought convenient ways to bake at home.

Despite its growth, the market faces challenges such as competition from homemade mixes and other baked goods. Health-conscious consumers may also avoid prepared flour mixes due to additives and preservatives. However, there are opportunities for growth in the market by developing healthier and organic flour mixes to attract the increasingly health-conscious consumer segment. By addressing these concerns and focusing on evolving consumer preferences, the Global Prepared Flour Mixes market has the potential for further growth in the future. The market can capitalize on the convenience and home-baking trend to expand its reach and meet the demands of the evolving consumer market.

MARKET SEGMENTATION

By Product

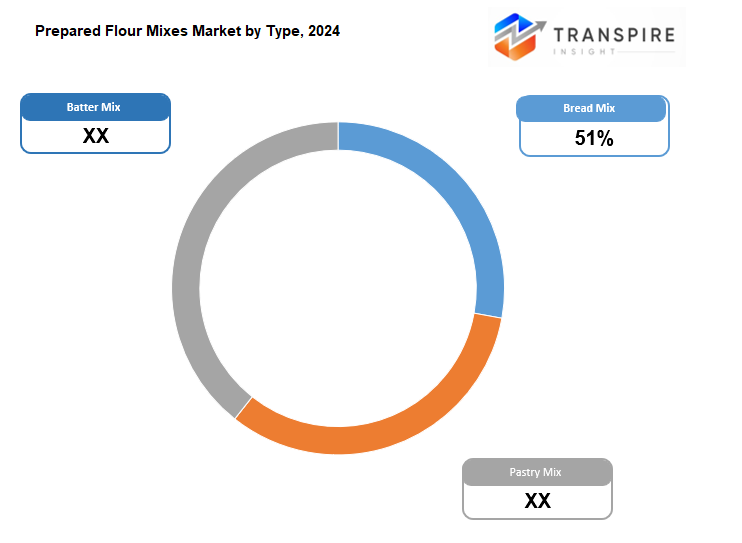

Changes in consumer preferences are driving the Global Prepared Flour Mixes market, with products like bread, pastry, and batter mixes gaining popularity for their convenience and time-saving benefits. The bread mix segment is thriving as demand for easy-to-prepare bread options increases, including specialty varieties like multigrain, gluten-free, and artisan breads. Health awareness is also driving the development of healthier bread mixes. Pastry mixes are also in high demand, catering to the growing interest in home baking for special occasions. These mixes simplify baking and allow for a variety of baked goods to be made at home. Batter mixes for breakfast foods like pancakes and waffles are also seeing a rise in popularity due to the need for quick and easy meal solutions.

These products cater to busy individuals and families seeking convenient meal options in today's fast-paced world. The market for prepared flour mixes is expected to continue growing as more people embrace the simplicity and enjoyment of home baking.

The market is also expected to expand with innovative products combining traditional meats with plant-based proteins to cater to flexitarians and those reducing meat consumption. Companies will invest in research and development to produce healthier processed meat products with fewer preservatives and additives, to comply with changing health regulations.

By Application

The global Prepared Flour Mixes market is expected to see significant growth in the coming years due to the increasing demand for convenience in households and industries. These mixes offer a quick and easy baking solution without compromising on quality. They cater to the need for quick and easy meals as more people desire convenient baking options at home. Mixes also address special dietary requirements such as gluten-free or low-sugar options to meet the needs of health-conscious consumers.

Bakery shops benefit from the Prepared Flour Mixes market as these mixes provide consistency in taste and texture, ensuring repeat business and a competitive advantage. With the rise in demand for artisanal and premium baked goods, there is also a growing need for high-end, customized flour mixes. The food processing industry has also embraced Prepared Flour Mixes to increase efficiency in producing large-scale baked products, meeting the rising demand for processed foods globally.

As consumer preferences evolve, the Prepared Flour Mixes market will continue to grow, adapting to changing technologies and consumer demands. The market will see new formulations and innovative ingredient additions to meet the needs of households, bakery shops, and food processing industries. This market is expected to play a significant role in the future of the global food industry by providing convenient and quality solutions for various applications.

REGIONAL ANALYSIS

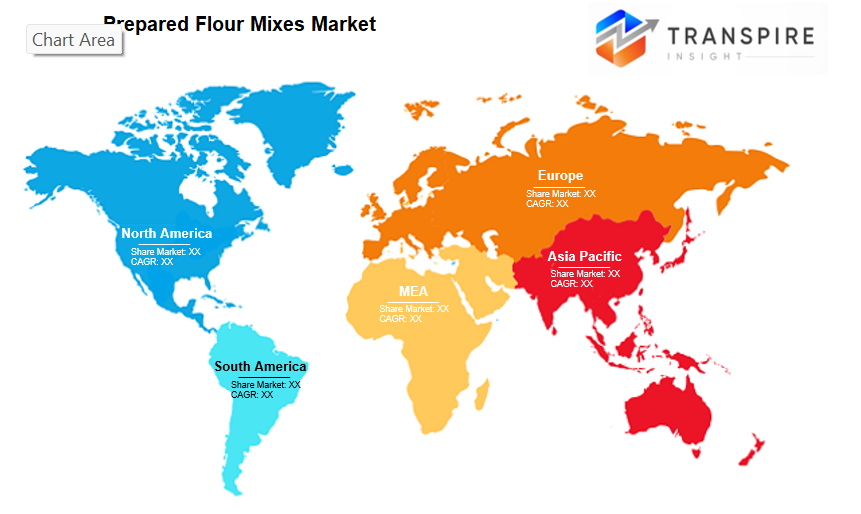

The Global Prepared Flour Mixes market is diverse, with different regions presenting unique opportunities and challenges. North America sees steady growth due to the fast-paced lifestyle, leading to a demand for convenient and healthier food options like gluten-free and high protein mixes. Europe's market is driven by the rich food tradition and the increasing interest in home baking, with consumers seeking health-conscious options like whole grain and additive-free products.

Asia-Pacific is experiencing the highest growth, driven by the growing middle class and urbanization, resulting in a preference for convenient food products like flour mixes. South America is also seeing growth, influenced by traditional cuisines and exposure to international food trends. The Middle East & Africa market is developing, driven by economic growth and changing consumer lifestyles with an increasing interest in Western-style diets.

Overall, each region contributes to the global growth of the market with localized consumer preferences, economic conditions, and evolving food trends shaping the demand for Prepared Flour Mixes. Companies are expected to focus on regional customization and product innovation to meet the growing demand in this market.

KEY INDUSTRY PLAYERS

The Global Prepared Flour Mixes market is competitive, with key players like ADM, AB Mauri, and Allied Pinnacle Pty. Ltd. leading the industry through innovation and advanced manufacturing techniques to meet current and future demand. Consumer preferences for healthier and more convenient foods have led to trends like gluten-free and low-sugar mixes. Technological advancements by companies like AngelYeast and Bakels Group have improved product quality and shelf life, enhancing consumer satisfaction and competitive advantage.

Sustainability practices are becoming more important, with companies focusing on eco-friendly production methods to reduce environmental impact. Strategic collaborations and partnerships, such as those by Griffith and Interflour Group Pte. Ltd. , are helping companies expand in emerging economies and ensure a stable supply of raw materials. Companies like Nisshin Seifun Group Inc. and PURATOS are entering new markets in Asia and Africa to tap into growth opportunities driven by urbanization and changes in food consumption habits.

Overall, the outlook for the Global Prepared Flour Mixes market is positive, with leading companies like Showa Sangyo, Yihai Kerry, and Rich Products Corp. continuously innovating and adapting to market changes. Competition among these players will drive further growth in product offerings and production methods, benefiting consumers with a variety of high-value, healthy, and convenient products.

REPORT SCOPE AND SEGMENTATION

|

Attributes |

Details |

|

Market Size By 2031 |

USD 44,110.4 Million |

|

Growth Rate |

CAGR of 7.8% |

|

Forecast period |

2024 - 2031 |

|

Report Pages |

250+ |

|

By Type |

|

|

By Application |

|

|

By Region |

|

|

Key Market Players |

|

_page-000119.jpg)

_page-000122.jpg)

_page-000121.jpg)

_page-000120.jpg)

5.jpg)

4.jpg)

APAC:+91 7666513636

APAC:+91 7666513636